Is Finance Transformation in Your Future? It’s a Major Priority. See what Gartner has to say.

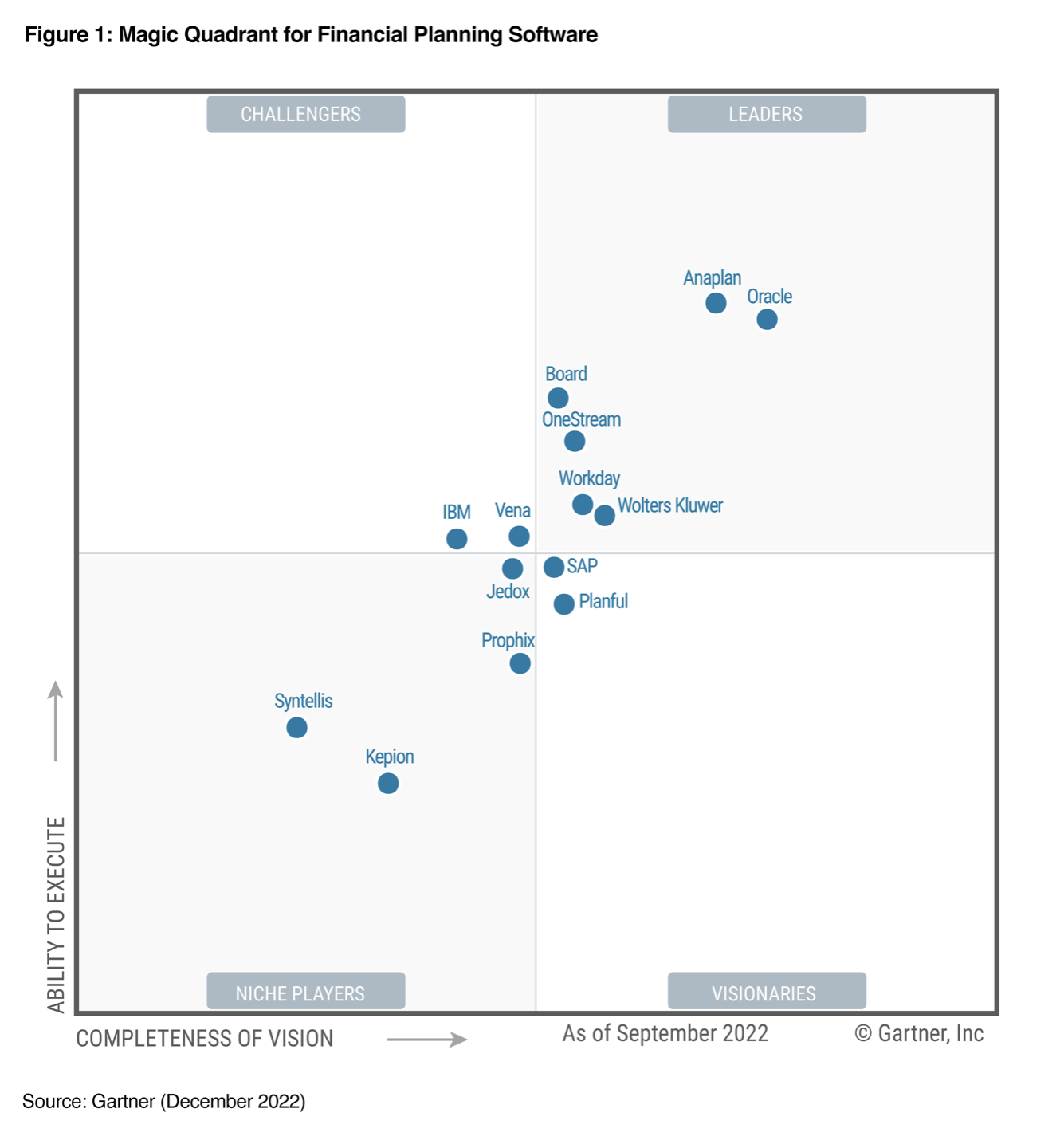

Gartner recently issued its all-new Magic Quadrant for Financial Planning Software, naming Anaplan a leader based on its ability to execute and completeness of vision. With the publication of this inaugural Magic Quadrant, there is validation in the marketplace that FP&A leaders like you are looking for capabilities that meet the foundational needs of finance but must also enable enterprise-wide planning.

In fact, according to Gartner’s “CFO Top 10 Priorities” survey from November 2022, 90% of respondents selected “evaluating finance strategy, scope and design” as the top priority, followed by “planning and sequencing finance transformation activities.” Additionally, a recent PWC Pulse Survey reveals that 53% of CFOs “plan to accelerate digital transformation using data analytics, AI, automation and cloud solutions.”

The start of a new year offers a chance to reflect, set new goals and re-focus your objectives. As a finance leader planning for the year ahead, you recognize that not everything is new – for example, prolonged, extreme disruption in the form of inflation, rising interest rates, geopolitical conflict, and supply chain issues. Because of that, the pressure is on you to as an FP&A leader to develop growth targets and strategies in partnership with the executive team.

To make that partnership work, flexible technology to facilitate quick analysis, provide actionable insights and decision-making is key. In fact, this evolving partnership is one of the primary contributors to the growth of the financial planning software market, with Gartner noting that “this development will be driven by the rise in demand for CFOs to play a critical role in steering the business via strategic decision support, while also executing planning and forecasting more efficiently, increasingly through automation and intelligent systems.”

This blog explores some of the capabilities you’ll need to unlock insights and deliver business value faster than ever before.

What is the 2022 Gartner Magic Quadrant for Financial Planning Software?

A Gartner Magic Quadrant is a culmination of research in a specific market, giving you a wide-angle view of the relative positions of the market’s competitors. It helps you quickly ascertain how well technology providers are executing their stated visions and how well they are performing against Gartner’s market view. Gartner defines financial planning software as the key tool that enables organizations to manage their enterprise-wide financial planning, forecasting, and budgeting processes.

Anaplan is positioned as a Leader in the 2022 Gartner Magic Quadrant for Financial Planning Software and placed highest in the Ability to Execute. To see the full Gartner evaluation of Anaplan’s capabilities and cautions, read the complimentary report.

The Financial Planning Software Magic Quadrant provides buyers with analysis of vendors’ capabilities in end-to-end management of enterprise-wide financial planning (or as we’ve called it since 2017, Connected Planning), budgeting and forecasting processes, flexible, user-friendly modelling, and ability to support Integrated Business Planning (IBP). Also at the forefront of evaluation is AI/ML capability with Gartner noting that “these more advanced forms of analytics are a differentiator” as finance leaders seek “increased levels of automation and intelligence”.

Advanced Analytics and Predictive Capabilities

Meeting your customers’ expectations, reacting to macro market influences, and responding to fluctuations while also balancing financial performance requires an understanding of your numbers beyond traditional accounting to identify trends and opportunities. As such, finance teams like yours are increasingly seeking better ways to harness data from internal and external data sources, uncover trends and other business drivers, and leverage advanced capabilities to improve forecasting accuracy.

Anaplan customers use PlanIQ to take advantage of statistical and AI/ML-based forecasting techniques to improve projections that include variables and constraints and to identify an ideal path forward. In short, you can better align your financial plans with operational decision making. Or, as Gartner explains, “with AI capabilities such as predictive analytics and system-generated data insights, CFOs are poised to provide even more enhanced data-driven, decision-making capabilities.”

Enterprise-wide financial planning

Achieving your goals requires planning alignment across the enterprise. Gartner recognizes that “Increased cross-functional collaboration is a key priority for organizations evaluating financial planning software.”

Finance leaders are turning to technology to support the connection of financial goals and operational plans in sales, finance, HR, and supply chain. With this visibility, finance can work with business leads to identify opportunities and speed up time to value. Gartner says that “the demand for better collaboration between different regions and functions is important to drive efficient and more meaningful forecasting and planning efforts.”

Supporting both Integrated Business Planning (IBP) and Integrated Financial Planning (IFP), Anaplan meets the needs of finance leaders wherever they are in their transformation journey from data collector to value creator by providing both core finance processes and operational planning processes.

How do these capabilities help to drive business value?

Growth and profitability will always be a top priority for CEOs. Unfortunately, market disruption is a constant force in opposition to this. As mentioned earlier, the roles of CFOs and FP&A leaders have evolved over the years, transforming them into business partners in developing growth targets and the strategic visions to achieve them. Finance leaders must have advanced planning tools to understand the business drivers across all business units, set meaningful, unbiased top-down and bottom-up goals, and leverage tools like scenario modelling to analyze the impact of variables to produce contingency plans and spot competitive opportunities. This enables organizations to quickly pivot and course-correct with confidence. These models must also be flexible and accessible without IT involvement.

Conclusion

With this publication and Anaplan positioned as a Leader in the first Gartner Magic Quadrant for Financial Planning Software, we believe 2023 will be the year of a tectonic shift as organizations move away from legacy software solutions to connected planning to fuel revenue growth, optimize costs, and mitigate risk in financial planning. Are you ready? Access the latest analyst research to see what else leading industry analysts predict for the market to help you make the business case for transforming your planning platform.

GARTNER is a registered trademark and service mark of Gartner and Magic Quadrant is a registered trademark of Gartner, Inc. and/or its affiliates in the U.S. and internationally and are used herein with permission. All rights reserved.

This graphic was published by Gartner, Inc. as part of a larger research document and should be evaluated in the context of the entire document. The Gartner document is available upon request from Anaplan

Gartner does not endorse any vendor, product or service depicted in its research publications and does not advise technology users to select only those vendors with the highest ratings or other designation. Gartner research publications consist of the opinions of Gartner's research organization and should not be construed as statements of fact. Gartner disclaims all warranties, expressed or implied, with respect to this research, including any warranties of merchantability or fitness for a particular purpose.