Four pillars of a best-in-class B2B sales operation

Well-run sales operations enable the B2B sales organization to fulfill its mission: bringing home revenue. That means positioning sales within an overall revenue engine.

Sales operations is a fairly new discipline, and to the other business departments it works with, it can be something of a black box. The sales organization often has an internal culture and language all its own. So the temptation may be strong to just let sales experts operate on gut instinct as long as they deliver.

But experience has shown that companies see the most sales success when they position B2B sales as part of an overall revenue engine that works in tandem with marketing, customer support, supply chain, and other functions to deliver an outstanding experience. And as part of a larger revenue engine, sales ops has evolved best practices that look a lot like the planning, metrics, and analytics its sister departments use to maximize their own outputs.

Simply put, sales operations teams should work to ensure that the sales organization can effectively do what it is designed to do: bring home revenue. Sales ops should be structured to monitor and improve sales performance—from tracking performance trends, to reducing seller friction, to ensuring that technology is working on the team’s behalf and not the other way around.

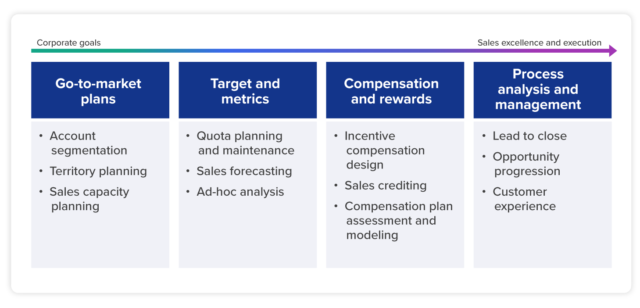

A strong framework for sales ops is built on four pillars:

- Go-to-market planning

- Targets and metrics

- Performance and rewards

- Process analysis and management.

These pillars are not meant to cover an exhaustive list of all the tasks and accountabilities that sales operations teams have in the real world. Rather, they are meant to represent the fundamentals for generating more revenue and accelerating growth. Ideally, these pillars also stand underneath the broader banner of revenue operations, which can help to coordinate operations activities across all revenue-facing teams.

The image below shows how these pieces form a best-in-class sales operations framework.

To understand why this framework is important, let’s look at a few of the key questions that every commercial strategy must address.

Question 1: Who is our ideal customer?

Even for the most ambitious enterprise, there are simply too many individuals and too many businesses in the world to sell to everybody. You need to narrow down all these possibilities into more manageable segments.

In today’s selling environment, this means intelligently prioritizing your market, but also maintaining line of sight into performance, and ensuring flexibility so that you can make changes to the go-to-market approach throughout the year.

There are some pretty sophisticated tools available for providing insights into buyer propensity and intent. When you can build this analysis into the account segmentation and scoring process, resource allocation becomes clearer.

Most companies still base these decisions on old transactions or assumptions. At best, they take an “inside-out” view, prioritizing accounts based on criteria they have drawn up internally.

Some of the biggest companies still do this work using spreadsheets (in some cases, hundreds or thousands of spreadsheets), which is an inefficient and error-prone process. Often, the sales reps don’t get their quota numbers until several months into the fiscal year. That means they’ve spent up to a quarter operating on best guesses—which can lead to a lot of missed opportunities.

Question 2: How do we improve sales performance?

Keeping a large and diverse sales organization motivated quarter after quarter is tough work. It takes sound management, challenging but attainable quota planning, and a sales incentive plan that is created and managed effectively.

Yet even more difficult is directing the sales organization’s motivation and focus on the right opportunities at all times, particularly when corporate objectives change. For example, a company might launch a new product, requiring a new commission-based incentive.

Making necessary changes to a sales incentive plan can be demotivating and demoralizing to sales reps and managers alike. For this reason, it’s necessary to model and stress-test various scenarios before rolling out changes across the organization. This type of scenario-based planning can help you anticipate the downstream consequences of various different incentive plans.

Develop a sales tech stack early on and be picky when choosing tools. The marketplace is crowded with tools that are chock-full of functionalities, but the quality of information they provide and their ability to connect with other tools are what determine their value.

Incentive compensation tools are a prime example. Some look great because they can easily calculate commission payments. However, the deciding factor is their ability to connect incentive comp management with larger corporate objectives. As we all know, paying commissions in a timely manner is important. And some comp programs have a better ROI than others.

Make sure you choose sales technology solutions that don’t determine your process. The technology, regardless of what functionality it provides, must be able to mold to your process—not the other way around.

Question 3: How can we improve our forecasting and make revenue more reliable?

Many companies have experienced inaccurate sales forecasts, which can lead to disastrous results. A forecast that is off by even a few percentage points can mean missed opportunities, poor investment decisions, mismatches between supply and demand, and mistrust between sales and corporate leadership—particularly of the CFO.

There are a few proven methods for achieving more accurate forecasting. One is with a better system for qualifying deals in pipeline. Is a deal hitting all the criteria in the methodology? Then put resources there and table underperforming leads.

Look at timing: How long has a deal been in the forecast? Avoid deals lingering on the forecast for several quarters or even years. These opportunities often become increasingly unlikely to close as time goes on, and they waste sales resources in the process. Getting the right, well-qualified deals in the pipeline makes sales more effective.

Another method which has gained traction throughout the COVID-19 pandemic involves leaning less on historical sales results as a benchmark for future forecasts. Demand has shifted. Entire industries have been forced to rethink their sales and distribution strategies. Forecasting needs to follow by embedding predictive insights and predictive lead scoring into the process. These insights can work alongside internal knowledge and data to drive more accurate forecasting.

Finally, at the deal desk, remember that contracts live long past the initial sale. Consider the lasting effect of the terms in every contract. Bad contracts can come back to haunt a company’s future financial results. This can be a potential disaster when trying to obtain future investment.

Achieve best-in-class sales operations

Besides these fundamental questions, sales operations are often accountable for several key administrative and operational tasks. These may include technology selection and administration, training and sales enablement, and the lead-to-close process including contract negotiation.

Taking a broader view, sales operations should ideally be a key piece of revenue operations, which can help to coordinate operations activities across all revenue-facing teams. This can help to ensure an outstanding customer experience before and after a sale is made.

Establishing an effective sales operations framework based on these pillars allows sales to function efficiently within an organization. The transparency created by this framework builds trust, and is a part of establishing clear expectations and determining the best use of resources. Consider the upfront work in establishing a sales ops framework a long-term investment that helps pave the way for growth.