Empowering FP&A to bridge the strategy-execution gap - Part 3

Part 3: How FP&A can help bridge the SEG

When was the last time you played out a scenario in your head? Have you ever imagined how a stakeholder might react when presented with the latest financial report? Or perhaps you’ve considered how your partner might react if you forgot to grab dinner on the way home (again).

Thinking about the future and the possible scenarios isn’t just something most humans do; it’s essential for businesses too, to overcome the Strategy-Execution Gap (SEG)

In our previous two blogs on this topic, Identifying the Strategy Execution Gap, and Why FP&A can help bridge the SEG, we discussed what strategy is and how to identify the SEG within your business, why FP&A teams are perfectly placed to help overcome the SEG as well as the roles and responsibilities you need in your team to make it happen.

In this final part of our series, we’ll delve into how you can overcome the SEG and give your business a competitive edge. Taking the findings of our research report, Empowering FP&A to Bridge the Strategy-Execution Gap, we’ll also offer a range of practical, innovative steps to get you started.

Scenario Management

Our research with FP&A professionals reveals Scenario Management is key to overcoming the SEG. Traditionally, scenarios focused on best-case, worst-case, and base-case options. However, this only works in a stable, consistent market.

Without a crystal ball to hand, and in our dynamic fast-paced world, Scenario Management enables businesses to envision and evaluate multiple possible futures, each with a full P&L, balance sheet and cash flow, for more informed decision-making and preparation for potential disruption.

Here’s how you can get started with Scenario Management in six simple steps:

- Decide on a scenario focus: Discuss with peers and stakeholders where the SEG is occurring.

- Identify drivers behind the current trends: Look at the associated trends of the focus area.

- Determine options: Write a description of three or four scenarios that could happen.

- Analyze scenarios: Document the results of each scenario and compare them with the current plan.

- Create an action plan for the selected scenario(s): Outline the necessary resource reallocation and the overall impact on organizational goals.

- Communicate the most likely scenario: Select the scenario deemed the most realistic and communicate it to all stakeholders.

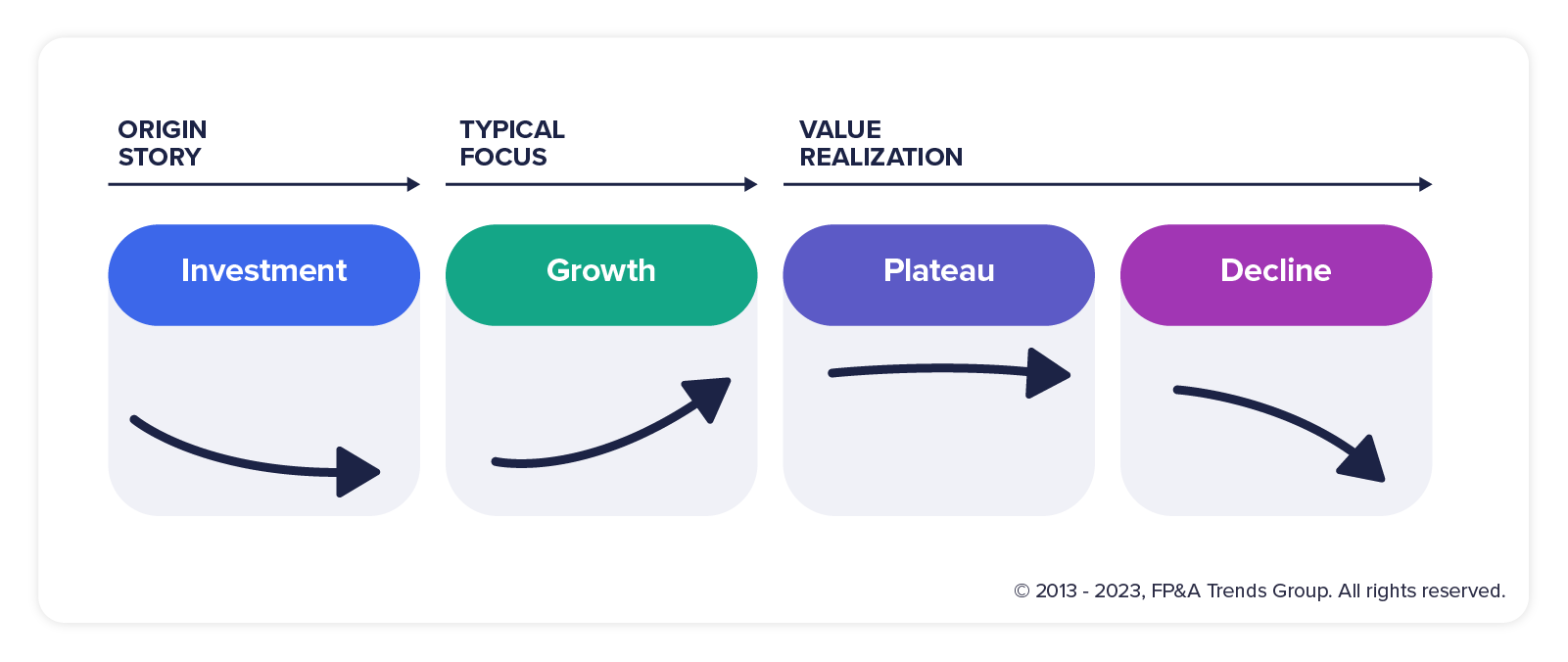

According to Michael Huthwaite, Director of Product Management, Intelligent Reporting at Walmart, most business initiatives, products and strategies follow a four-phase lifecycle (see diagram above). Every business will have multiple products and initiatives running concurrently and at different stages.

To prevent the SEG and get a realistic view of potential cash flow and profit, you should model each product and initiative individually, according to the stage it’s at. This approach allows you to forecast more accurately and highlight areas that require additional investment.

Creating the FP&A roadmap

When you’re faced with a finance transformation project it can feel overwhelming. What you need is the full picture in real-time so you can assess your financial position and determine your next move. Put simply, you need a FP&A roadmap.

First, you need to take stock. Unless you know where you are today, you won’t know where to start the project. Working with stakeholders, you can build a roadmap that takes you where you want to be. Because as we all know, transformation is a journey, not a destination.

To help you navigate the SEG process effectively, we developed a Strategy Execution Maturity Model. Not only does it enable you to assess where you are today, it provides the steps you need to move along the five-stage journey. You can download the model here.

At each stage in the maturity model, there are six areas where FP&A are involved:

- Data: Ensuring the availability of accurate, reliable, trusted internal and external data in multiple formats and in real-time.

- Modeling: Developing models that reflect the lifecycles of your products/services allowing for comprehensive P&L, cash flow, and balance sheet analysis.

- Analysis: Using internal and external performance drivers within the models, incorporating AI/ML techniques for prediction and scenario analysis.

- Process: Aligning strategic, financial, and operational processes to create and execute on a unified strategy.

- Technology: Implementing a comprehensive planning platform that serves as the single source for all users to plan around a shared business model.

- FP&A Role: Partnering across the organization, FP&A extends the reach beyond finance to operational areas and oversees how business value is created.

Starting your journey

When you embark on your transformation journey, empowering FP&A across all levels of the business, not just within finance, is required. By leveraging data and identifying the key drivers impacting performance, your FP&A team can ensure collaborative planning between departments and allow a clear understanding of the lifecycle stage of each product/service/initiative. Therefore, laying the foundation for effective Scenario Management with more informed decision-making, helping you to drive the business forward.

Conclusions and Recommendations

FP&A serves as the transformation champion at the heart of your business. By adopting flexible processes, leveraging modern planning technology, and using clean, reliable data, your FP&A teams can perform robust Scenario Management, connect siloed departments and help your organization avoid the SEG.

“Organizations must move away from periodic and static processes supported by legacy systems patched with spreadsheets. Instead, planning should be agile and continuous to enable real-time decision-making.”Chris Davenport, Business Value & Strategy Director at Anaplan

Final thoughts for your FP&A:

FP&A serves as the transformation champion at the heart of your business. By adopting flexible processes, leveraging modern planning technology, and using clean, reliable data, your FP&A teams can perform robust Scenario Management, connect siloed departments and help your organization avoid the SEG.

- Acknowledge that the SEG exists and recognize its negative impact on performance and strategic goals.

- Secure senior management buy-in and ensure they understand that traditional processes are no longer effective.

- Embrace the fact that overcoming the SEG requires cultural change across departments, it’s not just another project.

- Use a phased, build-and-test approach involving stakeholders. Transformation is a journey, not a destination.

- Educate users and upskill finance teams on the latest predictive technologies.

- Adopt a Strategy Management approach to navigate uncertainty.

Why not get your journey started right now? You can contact FP&A Trends or go to Anaplan to learn more about how Anaplan can help you overcome the SEG in your organization.

About the authors

Michael Coveney, Head of Research at FP&A Trends Group, has over 40 years of experience in designing and implementing software solutions that combine ‘best management practices’ with technology to improve the efficiency and effectiveness of planning, budgeting, forecasting and reporting processes. He has conducted senior management workshops with leading organizations around the world and led courses for the American Management Association and Antwerp Management School on the topic of Corporate Performance Management. His energetic style and extensive experience led him to become a regular speaker at many international events and the author of many articles and books. His latest, ‘Budgeting, Planning and Forecasting in Uncertain Times’ is published by John Wiley & Sons. In recent years he has focused on the role of IT within FP&A departments.

Larysa Melnychuk, CEO at FP&A Trends Group, is an accomplished FP&A professional and thought leader with over 20 years of experience in senior finance roles at top-tier companies. In 2016, she founded the FP&A Trends Group, a global organization that offers valuable insights, advisory services, and training to finance professionals seeking to stay ahead of the curve. Under her leadership, the FP&A Trends Group has conducted 20 innovative research and insight projects, including the widely recognized FP&A Trends Maturity Model. She also created the International FP&A Board, which has held over 200 meetings for finance leaders from 30 chapters across 16 countries on four continents. As a founder of the AI/ML FP&A Committee, Larysa is committed to promoting excellence and enhancing the profession globally.